|

Top Housing Market Predictions for The Remainder of 2022

This year, mortgage rates have risen by more than two and a half percentage points. Furthermore, the increasing expenses of purchasing a home have altered many prospective purchasers' calculations. As a result, year-over-year house sales have fallen in recent months. A record 79 percent of respondents in a Fannie Mae study on homebuyer sentiment indicated it's a poor time to buy a home. Home sales activity kicked out 2022 stronger than anticipated but rising costs have led to alter their forecast downward. Realtor.com now forecasts a 6.7% decline in house sales in 2022. They anticipate the greatest year-over-year decline in house sales at the customary peak of the summer selling season. Home sales on par with these predictions would mean that 2022 sales are the 2nd highest tally since 2007, trailing only 2021. Sales of existing homes have declined 8.6% year-over-year in May 2022. Declining home purchases means more people are renting. First-time buyers were responsible for 27% of sales in May, down from 28% in April and down from 31% in May 2021. Affordability has been hit with a triple whammy of rising interest rates, fast house price increase, and inadequate supply. In the second half of 2022, house price growth will moderate, although it has been hotter for longer than anticipated, resulting in an upwardly revised forecast of a 6.6% home price rise for 2022. That's an increase from their previous forecast of 2.2% growth in home prices. More than a decade of chronic underbuilding, coupled with millions of millennials entering the homebuying stage of life, has resulted in a major mismatch in housing supply and demand in the United States. Therefore, don't forecast a halt in the home price rise despite the fact that mortgage rates are rising significantly. While housing costs remain high, forcing homebuyers to make difficult decisions, it is predicted that the number of properties for sale will continue to increase, building on the reversal that began in May 2022. That is a sign of relief for first-time home buyers. Following a spate of volatility this week, the average rate on 30-year mortgages climbed to 5.78 percent from 5.36 percent the previous week, according to Bankrate’s national survey of large lenders. Housing Inventory Inventory of properties currently for sale on a typical June day rose 18.7% over the last year, the highest rise in record history. On an average June day, there were 98,000 more properties for sale than the year before. While overall housing inventory expanded, condominiums (and other connected homes) declined by 0.2%. Condos, which made up 20.2% of listings in June, are cheaper than single-family homes (17.5% cheaper in the 50 largest metro areas in June 2022) and have gained appeal in high-priced regions as single-family homes prices have risen. The number of unsold properties countrywide, including current and pending listings, was down 1.4% from June 2021. Last month's drop was 3.9%. Lagged improvement in the overall number of houses for sale is due to slowing buyer demand, pushed by increasing interest rates and all-time high listing prices that have increased the cost of financing 80% of the median property by 57.6% ($745 per month) compared to a year earlier. The number of pending listings on a typical day has fallen by 16.3% compared to last June, indicating a slowdown in demand is slowing inventory turnover. This decelerates from May's 12.6% annual drop. Lower competition and increased seller activity will help homebuyers. Increasing housing inventory is excellent news for buyers. Homebuyers will have additional options as a greater number of homeowners want to adapt their living situations to changing personal demands and take advantage of favorable market circumstances to access the substantial wealth they have accrued.

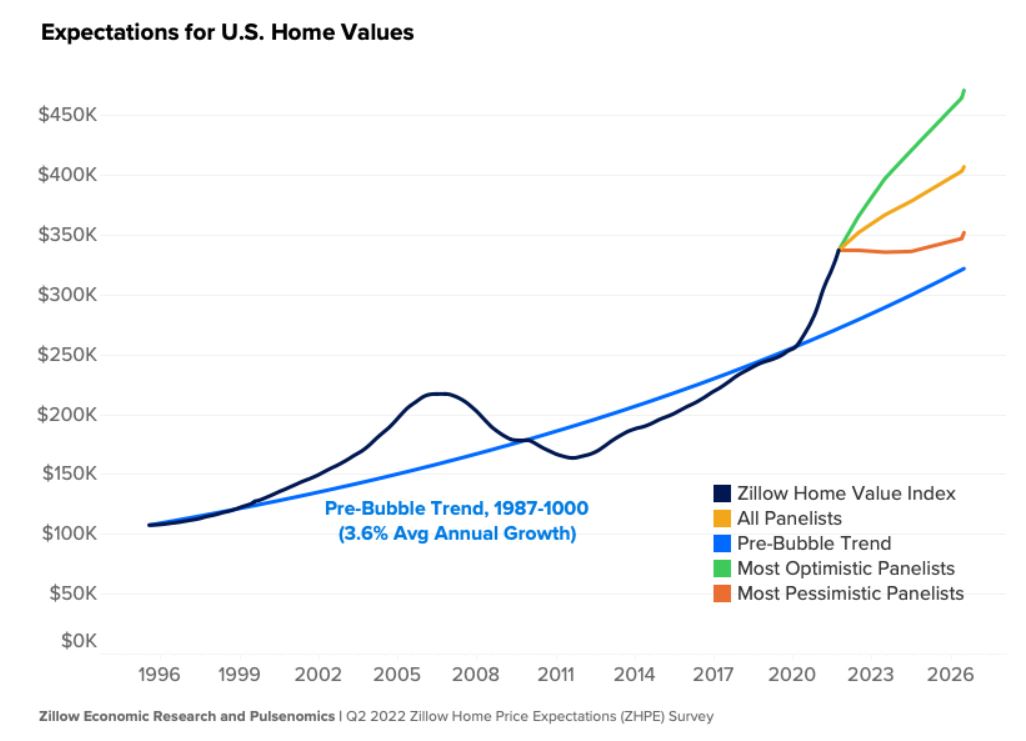

Housing Prices Inventory of properties currently for sale on a typical June day rose 18.7% over the last year, the highest rise in record history. On an average June day, there were 98,000 more properties for sale than the year before. While overall housing inventory expanded, condominiums (and other connected homes) declined by 0.2%. Condos, which made up 20.2% of listings in June, are cheaper than single-family homes (17.5% cheaper in the 50 largest metro areas in June 2022) and have gained appeal in high-priced regions as single-family homes prices have risen. The number of unsold properties countrywide, including current and pending listings, was down 1.4% from June 2021. Last month's drop was 3.9%. Lagged improvement in the overall number of houses for sale is due to slowing buyer demand, pushed by increasing interest rates and all-time high listing prices that have increased the cost of financing 80% of the median property by 57.6% ($745 per month) compared to a year earlier. The number of pending listings on a typical day has fallen by 16.3% compared to last June, indicating a slowdown in demand is slowing inventory turnover. This decelerates from May's 12.6% annual drop. Lower competition and increased seller activity will help homebuyers. Increasing housing inventory is excellent news for buyers. Homebuyers will have additional options as a greater number of homeowners want to adapt their living situations to changing personal demands and take advantage of favorable market circumstances to access the substantial wealth they have accrued. Homeowners continue to be in a favorable position, particularly those who have owned for extended periods of time and amassed substantial wealth. This is forecasted to attract additional sellers looking to capitalize on favorable market circumstances, resulting in increased competition and a rebalancing of the housing market away from its previous seller-friendly bias. This bodes well for seller-buyers who have been disappointed by the scarcity of purchasing possibilities. The forecast for inventory growth of existing homes for sale has increased from 0.3% to 15%. Price Forecast Through 2026 The Zillow home price expectations survey found that the housing market is likely to recover to pre-pandemic, 2019 norms by 2024, at least in terms of inventory and the proportion of purchases made by first-time home buyers. Home prices have grown 32 percent in the previous two years as a result of a shrinking number of properties on the market. The diminishing supply of available properties has been a major contributor.

The pandemic brought record-breaking price increases and rent increases that made saving for down purchases much harder. As a result, according to a Zillow survey of recent buyers, the percentage of first-time home buyers fell from 45 percent in 2019 to 37 percent in 2021. First-time purchasers would reclaim their pre-pandemic market share within the next two years, with 26 percent predicting 2024 and 25 percent predicting 2025. About 18% of experts surveyed said they don't expect the percentage of first-time buyers to surge over 45% until after 2030, despite many Millennials, the largest U.S. generation ever will be well into their prime home-buying years far before then. The median age of U.S. buyers is 43, while the average skews higher (45 years old). Almost one in five buyers (17%) are in their twenties or younger, while roughly a quarter (23%) are in their sixties or older. In other words, the age distribution of buyers represents somewhat of a middle ground when it comes to the U.S. population. They are typically younger than tenured homeowners (those who have not moved in the past year), but older than renters. Buyers tend to have higher household incomes than the U.S. population overall. The annual median household income among buyers is approximately $86,000, compared to the overall national median (2019) of $65,700. Another Zillow Home Price Expectations survey conducted in June shows that despite a more than 100-basis point increase in mortgage rates since the previous survey just three months ago and the potential for higher rates in coming months, the panel’s expectations for 2022 home price appreciation still rose to 9.3% from 9.0% last quarter. This would be a significant step down from the 19.6% appreciation observed over the 2021 calendar year, but still high above long-term historical averages. Looking ahead, the most optimistic quartile of respondents expected a 46.1 percent increase in prices between now and the end of 2026, while the most conservative quartile predicted a 9.3 percent increase in that period. Respondents anticipate a total increase of 26.4 percent by the end of 2026.

1 Comment

5/17/2023 10:06:18 am

This is a very helpful blog about housing.

Reply

Leave a Reply. |

|

NMREC# 18075

|

Address

1526 Cerrillos Rd.

Santa Fe, NM 87505 Toll-Free: 1-800-982-3084 Office: 505-982-2525 Fax: 505-984-8595 [email protected] |

Map

|

© 1999-2021 Varela Real Estate, All Rights Reserved. Real Estate Website by MIS, Inc.

RSS Feed

RSS Feed