|

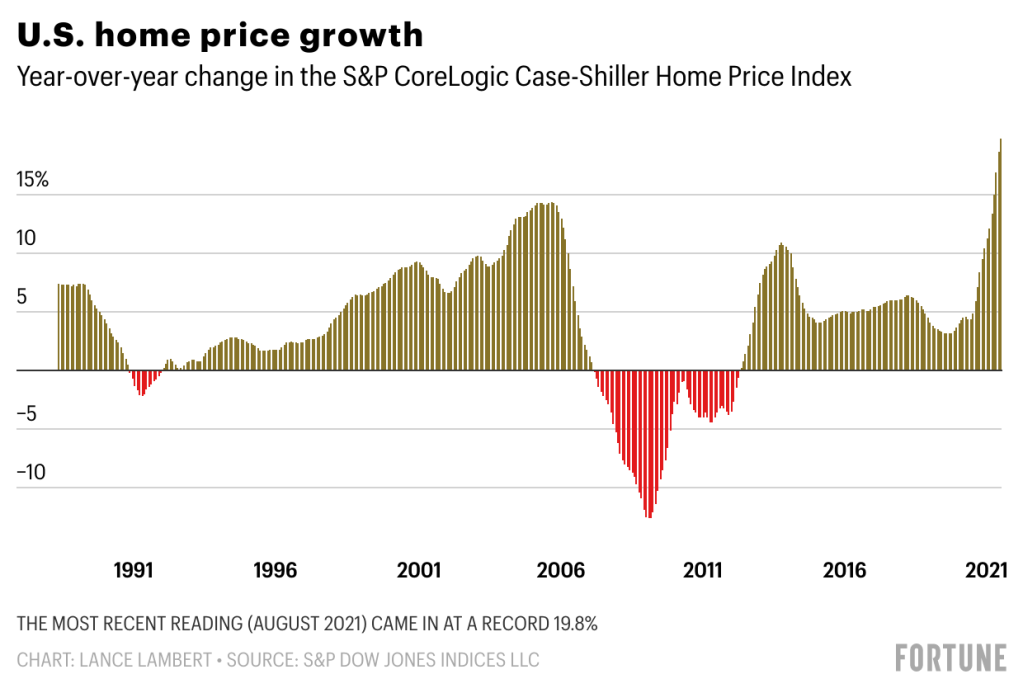

Over the past year, U.S. home prices are up a record 19.8%. You don’t need to be an economist to know that the current level of growth—which is faster than the run-up to the 2008 financial crisis—isn’t sustainable.

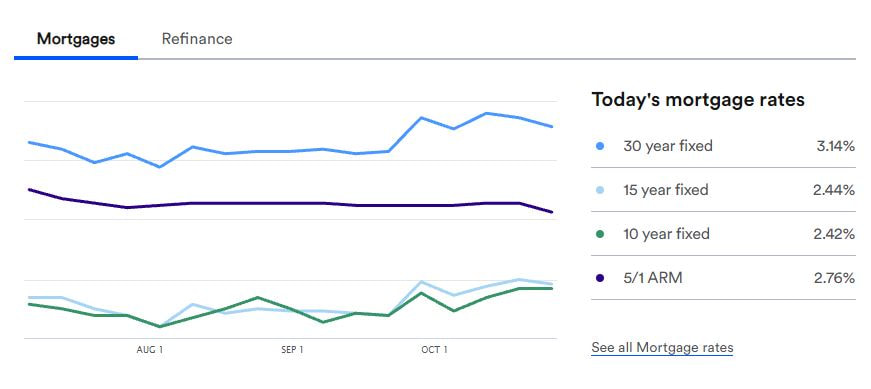

But where will this historically competitive housing market go next? According to the latest forecast put out by Fannie Mae, median home prices are expected to rise 7.9% between the fourth quarter of 2021 and the fourth quarter of 2022. While that would mark a slowing from the extreme price growth we’ve seen this year, it would still represent strong growth by historical standards. (On average, U.S. home prices have climbed 4.1% on an annual basis since 1987.) So, put another way: The housing market, at least in the eyes of Fannie Mae, is set to return to a normal-ish level of price appreciation. Fannie Mae also expects mortgage rates to climb next year, with the average 30-year fixed rate rising from 3.1% to 3.4%. But the downward pressure on prices from rising rates, the government-sponsored enterprise says, won’t be enough to actually pull prices down. “Mortgage rates may rise in response to the tighter environment, but we expect the severe shortage of homes for sale to remain the primary driver of strong house price appreciation through at least 2022, limiting interest rate effects on home sales and home prices,” wrote Doug Duncan, chief economist at Fannie Mae, in its latest 2022 outlook. As far as 2022 outlooks go, Fannie Mae’s forecast is a Goldilocks—right in the middle. On the bullish end of the spectrum are Zillow and Goldman Sachs. In the coming 12 months, Zillow foresees U.S. home prices jumping 13.6%. Meanwhile, Goldman Sachs expects home prices to swing up a staggering 16% by the end of 2022. But not everyone sees the frenzy continuing: CoreLogic, a real estate data firm, is far more bearish--forecasting just 2.2% home price growth over the coming 12 months. All of these forecasts should, of course, be taken with a grain of salt. After all, at the onset of the pandemic—when some states had banned in-person real estate viewings--CoreLogic forecast prices would fall 1.3% between April 2020 and April 2021. For that same 12-month period, Zillow predicted home prices would fall between 2% to 3%. Not only did the housing market not slide backward, it went on one of the biggest runs in U.S. history. Existing-Home Sales Increased 7% in September From August According to the National Association of Realtors®, existing-home sales increased in September after a decline the previous month. Each of the four main US areas had month-over-month growth. On a year-over-year basis, one area remained stable, while the other three showed declines in sales.

1 Comment

This is a nice Charts for U.S home price growth.

Reply

Leave a Reply. |

|

NMREC# 18075

|

Address

1526 Cerrillos Rd.

Santa Fe, NM 87505 Toll-Free: 1-800-982-3084 Office: 505-982-2525 Fax: 505-984-8595 [email protected] |

Map

|

© 1999-2021 Varela Real Estate, All Rights Reserved. Real Estate Website by MIS, Inc.

RSS Feed

RSS Feed