Housing Market Predictions For 2023: When Will Home Prices Be Affordable Again?

Because rates are high, Yun foresees a greater interest in adjustable-rate mortgages through next year. However, after that, he predicts 90 percent of Americans will return to the traditional 30-year fixed-rate mortgage. Greg McBride, CFA, Bankrate’s chief financial analyst, thinks the 30-year fixed will remain the dominant mortgage product. “It provides the certainty borrowers want, lenders can sell them to investors, and there is a vibrant secondary market of global investors eager to buy them,” he says. Predictions for home pricesYun foresees no major changes in purchase price tags on a nationwide level next year, with fluctuations of only about 5 percent one way or the other. The only exception is California, he says, where the market could see 10 percent declines: “Because it’s so expensive, California is always the most vulnerable to changes in interest rates.” This scenario is already playing out in the priciest areas in the state: For example, San Francisco median home prices are down 9.71 percent since last year, according to Redfin data. Overall, in five years, Yun expects prices to have appreciated a total of 15–25 percent. McBride predicts home prices will average low- to mid-single-digit annual appreciation over the next five years. This rate of appreciation, he says, is consistent with the long-term average of home prices increasing by a rate that hovers a percentage point above the inflation rate. Will the housing market crash?While it may show bubble-like characteristics, Yun does not expect the residential real estate market to pop. He does predict that sales will be at a low point next year, with only 5.3 million units sold, but he foresees a gradual increase afterward, up to an annual 6 million units by 2027. Despite today’s higher mortgage rates, home prices are still strong, he adds. Even if they decline 5 percent (or 10 percent in California) next year, that’s not anywhere close to crashing, which he says is characterized by a one-third drop. A crash happens with oversupply. It will not happen because there isn’t enough inventory. — LAWRENCE YUN, CHIEF ECONOMIST, NATIONAL ASSOCIATION OF REALTORS “A crash happens with oversupply,” Yun says. “A 30 percent decrease will not happen because there isn’t enough inventory.” He believes the housing supply will balance out within five years. Many other experts agree that there is no danger of an imminent housing market crash. Not only is inventory is too scarce, as Yun notes, but lending standards today are much stricter than they were back in the days of the Great Recession. Lenders are largely not issuing loans that borrowers can’t really afford anymore, which helps keep foreclosure rates low. Will we shift into a buyer’s market?Yun expects the overall seller’s market to continue as long as housing inventory remains low. By five years out, though, he foresees more of a balanced market, where neither the buyer or seller holds a significant advantage. Instead, the negotiating power between parties will be more equal and depend on the individual case. Affordability Struggles Sideline Hopeful Home BuyersIf now doesn’t feel like the right time to buy a home, you’re not alone. In fact, you’re among the 82% of consumers who reported putting home buying plans on hold, even as they say that they feel their job and income are stable or better than a year ago, according to the Fannie Mae Home Purchase Sentiment Index (HPSI). Thanks to escalating mortgage rates and still-high home prices, homeseekers on $3,000 monthly budgets who could have purchased a $500,000 home a year ago, can only afford a $429,000 home today, according to a recent Redfin report. First-time buyers hoping to land a home at a lower price point generally have it the worst. Starter home costs continue on an upward trajectory that has put homeownership further out of reach for those already constricted by limited down payment savings and incomes that can’t keep pace with costlier monthly payments, according to Realtor.com data. For example, monthly mortgage payments in Wichita, Kansas have exploded by 271% since 2019. It’s a similar story in many areas of the country that historically have been more affordable. Weakening affordability conditions for first-time buyers is further underscored in NAR’s latest First-Time Homebuyer Affordability Index. The preliminary second-quarter reading came in at 61.4, compared to 67.4 in the first quarter. A reading of 100 indicates that a family earning a median income earns exactly enough to qualify for a mortgage and afford a typical home. In other words, the typical first-time home buyer is nowhere near earning the level of income required to afford a home. Are Home Prices Beginning to Drop?Despite signs that home prices are beginning to weaken in some regions, the housing affordability crisis is likely to perpetuate thanks to a meager housing supply, persistently high mortgage rates and sales prices that are flirting with the June 2022 record-high median existing-home sales price of $413,800. The median existing-home sales price slid to $406,700 from $410,200 between June and July, but increased 1.9% from a year ago, according to NAR.

0 Comments

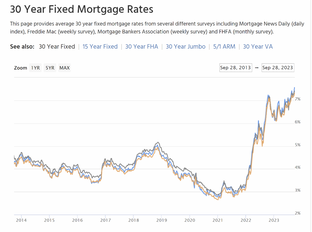

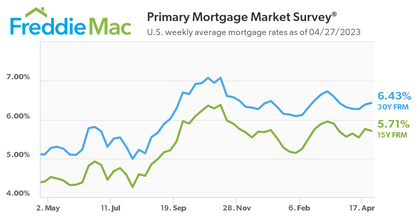

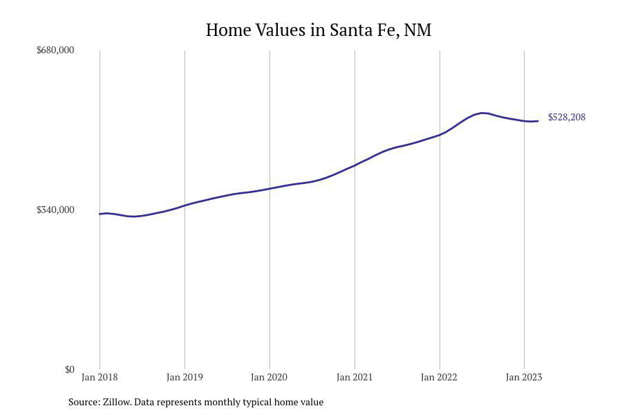

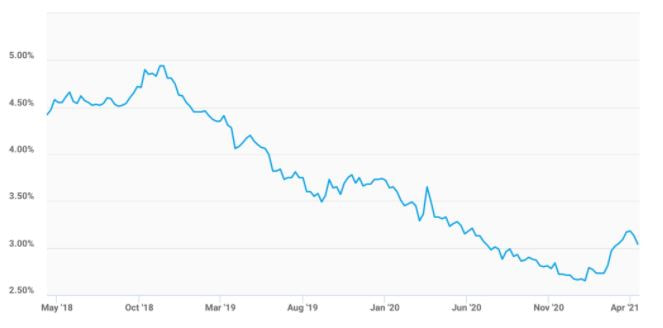

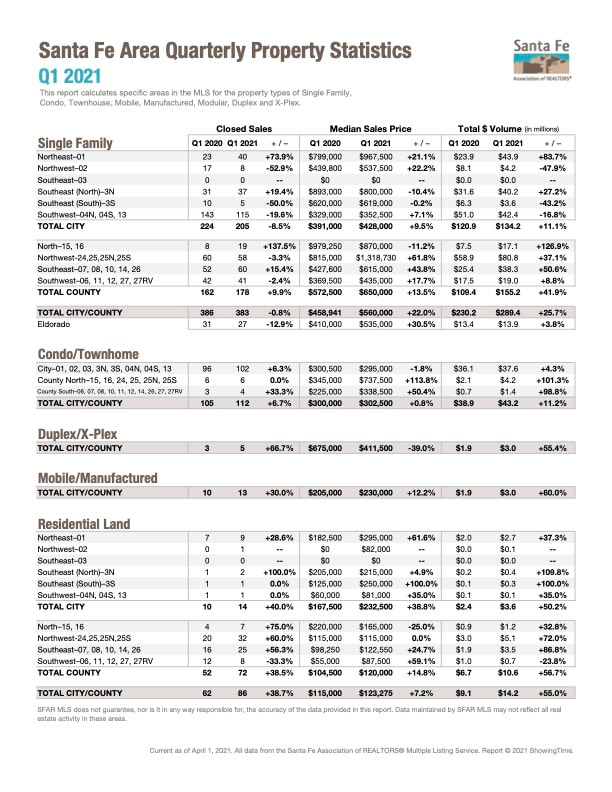

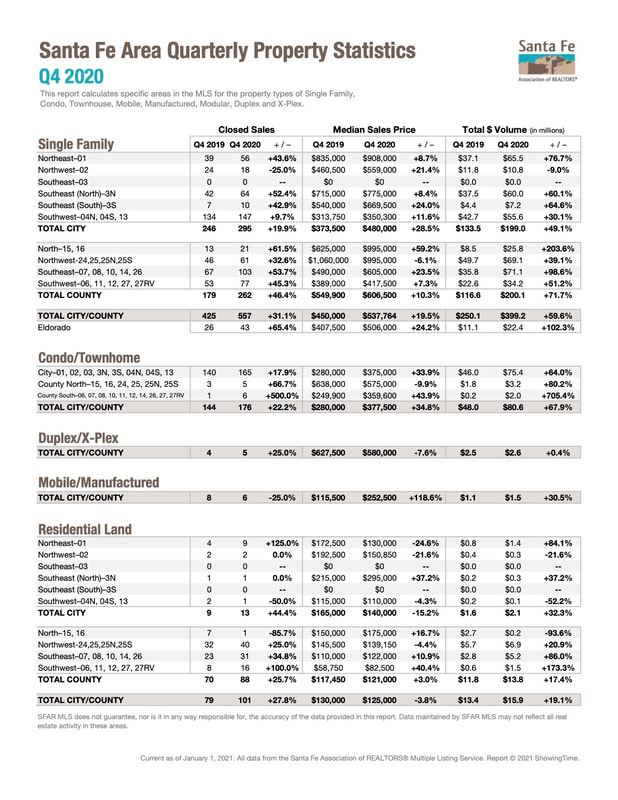

Housing Development & Occupancy Land sales in Santa Fe City and County increased by 21 percent in 2021 – a robust increase likely due to easing pandemic controls and demand. Land sales continued to climb in Santa Fe County during 2021 along with Santa Fe City where land sales rose by 9 percent. In Santa Fe City, multi-family developments have outpaced single family construction in the last three years largely in part to Santa Fe City efforts to modify inclusionary zoning requirements for developers allowing a “feein-lieu” of building affordable rental units and other flexible options. Total units increased from 1,717 in 2006-2008 to 2,656 units in 2019- 2021 or by about a remarkable 55 percent. Looking at building permits during the same timeframes in Santa Fe County, building permit growth slowed about 12 percent from 834 permits in the last housing boon of 2006-2009 to 739 in the last three years. In Santa Fe County, approximately 74.4 percent of housing units are occupied by their owners. Within Santa Fe City, 68.6 percent of homes are owner occupied while 31.5 percent are renter occupied. Population & Income In 2021, the U.S. population grew by 1 percent, the slowest growth rate since the founding of the country. During this same period, New Mexico’s population declined by 1 percent while Santa Fe County’s population grew by 2 percent. Between 2015 to 2019, Santa Fe attracted more people from both domestic and international areas resulting in a positive net migration total of 2,850 people while New Mexico lost residents to other domestic areas. Santa Fe remains attractive to retirees and remote workers who come to the region to enjoy its climate, outdoor amenities, cultural attractions, art and history. In 2021, according to the U.S. Census American Community Survey 1-Year Estimate, Santa Fe City median household income was $60,517 or about 90 percent of the median household income in Santa Fe County at $67,341. In New Mexico, it was $53,992 or only about three-quarters of the U.S. median household income at $69,717. Santa Fe City’s living wage law indexed to consumer price increases likely contributes to the overall higher wages in the area. In the last three years with an influx of federal funding at Los Alamos National Laboratory (LANB), the lack of housing options in Los Alamos County has led to a growing number of LANB workers buying and renting properties in Santa Fe. Rental Housing In the January 2022 Coldwell Banker Richard Ellis (CBRE) Market Survey report, average rents were forecast in the Santa Fe area to begin at $1,528 in 2022 rising to $1,582 by years’ end. Moving forward, CBRE predicts rents to rise by only 2.9 percent in 2023 as prices stabilize in the rental market. Looking ahead, the September 2022 New Mexico Mortgage Finance Authority’s Housing New Mexico: A Call to Action report, forecast that Santa Fe County will need to bring online 678 rental units to meet projected demand by 2025 and a total of 2206 units by 2035. In 2022, Santa Fe County adopted regulations for short term rentals requiring a registration fee for owner-occupied units and business license for non-owner occupied units whom must come into compliance by March 15, 2023. Additionally, the county placed a one-year short term rental moratorium on properties purchased after November 25, 2022 restricting the ability of these new owners to rent on a short term basis. Housing Sales & Prices The Santa Fe real estate market demonstrated exceptional price growth during 2021 like many communities across the country. In Santa Fe City, the median price of a single family home increased by 14 percent to $488,500 in response to growing demand. In Santa Fe County, the median price of a single family home increased by a remarkable 20 percent to $691,803 in 2021 with sales up 5 percent compared to 2020. Both Santa Fe City and County tracked above the national median single family home price in 2021. Sales of housing priced under $250,000 has been shrinking from a peak in 2014 with a meager 22 single family homes sold in this price range during 2021. Meanwhile, homes priced between $350,001 to $450,000 experienced an increase in sales. Sales of high-end homes priced more than $750,000 made up the largest share of homes sold in 2021. Sales of condominiums and townhomes had a significant turnaround in 2021 rising by 24 percent. Market share of units was equally split between units priced under $350,000 at 332 with units priced over $350,000 at a total of 331. Mortgage Finance During the past year, inflation has been at a 40-year high in the United States imposing costs on all households but especially low-income households. The multiple waves of the pandemic, combined with Russia's war against Ukraine, unleashed a series of supply shocks hitting goods, labor, and commodities that, in combination with strong demand, have contributed to ongoing high inflation. In response to inflation, the Federal Reserve raised the federal funds rate by a total of 1.5 basis points since the beginning of 2022. It is anticipated that further increases will be needed to address inflation through the years end. In 2022, Fannie Mae and Freddie Mac conforming loan limits increased from $548,250 to $647,200 for a single family residence. With the increase homebuyers can better leverage their borrowing power, enjoying the benefits from inexpensive borrowing costs with higher loan limits. At the same time, construction rose by 11.5 percent exceeding the 2-4 percent increase predicted by industry analysts. Foreclosures in mid-year 2021 totaled 164,581 up 219 percent from the same time a year ago. According to RealtyTrac, foreclosure activity across the United States continued a slow, steady climb back to pre-pandemic levels in the first half of 2022. Housing Affordability The Housing Affordability Index (HAI) measures the ability of a family earning a median income to purchase a median-priced home. The HAI for Santa Fe City and County for a single family home has tracked under 80 for the last three years. Historic low inventory is negatively impacting HAI for all housing options in the Santa Fe region. To help address housing affordability, Santa Fe City and County have programs to require the construction of housing units for low-income residents through inclusionary zoning policies. Over the last ten years, 487 affordable housing units have been built to address housing affordability. In 2021, Santa Fe County’s unemployment rate dropped below New Mexico’s overall unemployment rate for the first time looking back at the last five years. Santa Fe’s unemployment rate decreased to 6.2 percent along with the rest of New Mexico during 2021 as the need for workers, similar to the rest of the nation, grew in the aftermath of the COVID-19 pandemic. Homelessness remains a persistent concern in Santa Fe, exacerbated during the COVID-19 pandemic as federal funding was accessed to provide mortgage and rent relief, services for the homeless, and the acquisition of Santa Fe Suites for housing. The annual point-in-time count of homeless people in January 2022 found 589 people living without housing with more permanent beds coming on line. With growing inflationary impacts on housing and the lack of low to middle housing inventory, there remains work to be done to ensure everyone in Santa Fe has a safe and stable home. Value Of Housing Housing is a key economic driver in the Santa Fe community and across New Mexico. The real estate industry accounted for $17.1 billion or 15.7 percent of the gross state product in 2021, down by $1 billion from 2020. Each home sold in New Mexico generates $93,500 in additional economic value to the community. A Look At Commercial Real Estate Over the last year, commercial real estate in Santa Fe has experienced robust sales and relatively stable leases. Commercial property owners are generally experiencing solid investment returns. Due to high construction costs, commercial properties selling at current market values are simply cheaper than building. There remains strong and growing demand for industrial space in the Santa Fe area. While large retailers are contracting in this category, there is a shortage of industrial and commercial zoned land available to meet the current demand Commercial retail is back with most of the open space available during the COVID-19 pandemic absorbed with lease prices holding and increasing. Commercial real estate professionals envision $21/ sq ft leases readily moving up to $27/sq ft to adjust for inflation and replacement value. In contrast to national trends, Santa Fe office space remains strong with a vacancy rate between 5 to 7 percent. Multi-family developments are experiencing growth in the Santa Fe market and offering returns to owners and investors. This growth may continue for a few more years but with the lack of reasonably-priced commercial land and long lead times for approvals, the pace may slow. Building on a trend of converting hotels and motels into housing, in 2022 Santa Fe City leveraged $400,000 of CARES Act funds and Santa Fe County contributed $800,000 to help subsidize the purchase of The Lamplighter Inn on Cerrillos Road to provide 58 units of affordable housing with 12 units set aside for transitional housing for the homeless. In the summer of 2022, Mountain Classic, a Salt Lake City real estate firm, purchased Quality Inn and Motel 6 along Cerrillos Road with the intention of converting the hotels into attainable housing with rents starting around $950 per month. Conclusion & Economic Outlook As the cost of housing increases, Santa Fe continues to attract residents seeking a more predictable and sustainable climate, diverse housing, world-class cultural amenities, multi-faceted outdoor recreation and unique art attractions found in a well-established sense of place. Domestic and international in-migration can further impact the housing shortage as remote workers purchase housing in resort markets like Santa Fe as well as a growing number of early retirees attracted to the region. In response to the increased need for more affordable housing and strong community advocacy, Santa Fe City set aside $3M for affordable housing in its most recent budgets while adding more multi-family and single family housing to its stock. Santa Fe County is finalizing its Housing Strategy Plan as a call to action to produce more housing while preserving existing affordable units. To further address the housing crisis, Santa Fe Housing Action Coalition is working collaboratively with a wide range of business, community, housing and government interests to identify and advocate for a permanent stream of annual funding. Santa Fe, like the rest of the nation, will enter 2023 with continuing economic uncertainty due to inflationary factors, ongoing geopolitical tensions, and intermittent COVID shutdowns affecting supply chains. Persistent high levels of inflation have led the Federal Reserve to continue to raise interest rates, with the resultant slowing of housing sales and rise in the cost of financing. Falling home sales have helped inventory to modestly improve, while the rise in interest rates is putting downward pressure on home prices in the near term.

Top Housing Market Predictions for The Remainder of 2022

This year, mortgage rates have risen by more than two and a half percentage points. Furthermore, the increasing expenses of purchasing a home have altered many prospective purchasers' calculations. As a result, year-over-year house sales have fallen in recent months. A record 79 percent of respondents in a Fannie Mae study on homebuyer sentiment indicated it's a poor time to buy a home. Home sales activity kicked out 2022 stronger than anticipated but rising costs have led to alter their forecast downward. Realtor.com now forecasts a 6.7% decline in house sales in 2022. They anticipate the greatest year-over-year decline in house sales at the customary peak of the summer selling season. Home sales on par with these predictions would mean that 2022 sales are the 2nd highest tally since 2007, trailing only 2021. Sales of existing homes have declined 8.6% year-over-year in May 2022. Declining home purchases means more people are renting. First-time buyers were responsible for 27% of sales in May, down from 28% in April and down from 31% in May 2021. Affordability has been hit with a triple whammy of rising interest rates, fast house price increase, and inadequate supply. In the second half of 2022, house price growth will moderate, although it has been hotter for longer than anticipated, resulting in an upwardly revised forecast of a 6.6% home price rise for 2022. That's an increase from their previous forecast of 2.2% growth in home prices. More than a decade of chronic underbuilding, coupled with millions of millennials entering the homebuying stage of life, has resulted in a major mismatch in housing supply and demand in the United States. Therefore, don't forecast a halt in the home price rise despite the fact that mortgage rates are rising significantly. While housing costs remain high, forcing homebuyers to make difficult decisions, it is predicted that the number of properties for sale will continue to increase, building on the reversal that began in May 2022. That is a sign of relief for first-time home buyers. Following a spate of volatility this week, the average rate on 30-year mortgages climbed to 5.78 percent from 5.36 percent the previous week, according to Bankrate’s national survey of large lenders. Housing Inventory Inventory of properties currently for sale on a typical June day rose 18.7% over the last year, the highest rise in record history. On an average June day, there were 98,000 more properties for sale than the year before. While overall housing inventory expanded, condominiums (and other connected homes) declined by 0.2%. Condos, which made up 20.2% of listings in June, are cheaper than single-family homes (17.5% cheaper in the 50 largest metro areas in June 2022) and have gained appeal in high-priced regions as single-family homes prices have risen. The number of unsold properties countrywide, including current and pending listings, was down 1.4% from June 2021. Last month's drop was 3.9%. Lagged improvement in the overall number of houses for sale is due to slowing buyer demand, pushed by increasing interest rates and all-time high listing prices that have increased the cost of financing 80% of the median property by 57.6% ($745 per month) compared to a year earlier. The number of pending listings on a typical day has fallen by 16.3% compared to last June, indicating a slowdown in demand is slowing inventory turnover. This decelerates from May's 12.6% annual drop. Lower competition and increased seller activity will help homebuyers. Increasing housing inventory is excellent news for buyers. Homebuyers will have additional options as a greater number of homeowners want to adapt their living situations to changing personal demands and take advantage of favorable market circumstances to access the substantial wealth they have accrued.

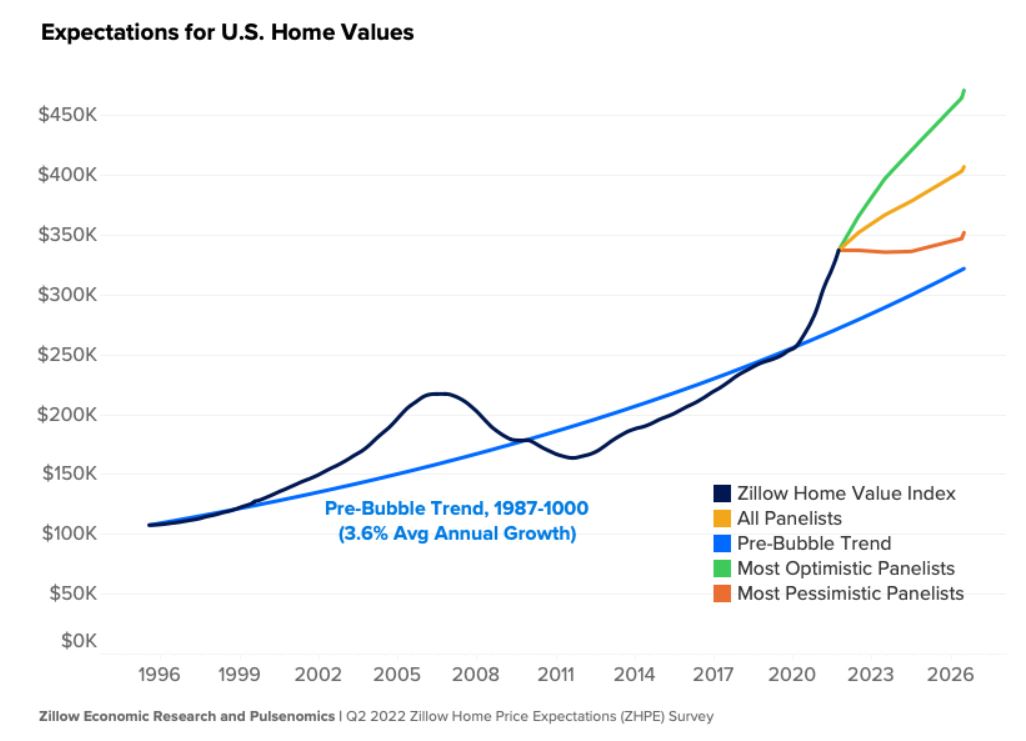

Housing Prices Inventory of properties currently for sale on a typical June day rose 18.7% over the last year, the highest rise in record history. On an average June day, there were 98,000 more properties for sale than the year before. While overall housing inventory expanded, condominiums (and other connected homes) declined by 0.2%. Condos, which made up 20.2% of listings in June, are cheaper than single-family homes (17.5% cheaper in the 50 largest metro areas in June 2022) and have gained appeal in high-priced regions as single-family homes prices have risen. The number of unsold properties countrywide, including current and pending listings, was down 1.4% from June 2021. Last month's drop was 3.9%. Lagged improvement in the overall number of houses for sale is due to slowing buyer demand, pushed by increasing interest rates and all-time high listing prices that have increased the cost of financing 80% of the median property by 57.6% ($745 per month) compared to a year earlier. The number of pending listings on a typical day has fallen by 16.3% compared to last June, indicating a slowdown in demand is slowing inventory turnover. This decelerates from May's 12.6% annual drop. Lower competition and increased seller activity will help homebuyers. Increasing housing inventory is excellent news for buyers. Homebuyers will have additional options as a greater number of homeowners want to adapt their living situations to changing personal demands and take advantage of favorable market circumstances to access the substantial wealth they have accrued. Homeowners continue to be in a favorable position, particularly those who have owned for extended periods of time and amassed substantial wealth. This is forecasted to attract additional sellers looking to capitalize on favorable market circumstances, resulting in increased competition and a rebalancing of the housing market away from its previous seller-friendly bias. This bodes well for seller-buyers who have been disappointed by the scarcity of purchasing possibilities. The forecast for inventory growth of existing homes for sale has increased from 0.3% to 15%. Price Forecast Through 2026 The Zillow home price expectations survey found that the housing market is likely to recover to pre-pandemic, 2019 norms by 2024, at least in terms of inventory and the proportion of purchases made by first-time home buyers. Home prices have grown 32 percent in the previous two years as a result of a shrinking number of properties on the market. The diminishing supply of available properties has been a major contributor.

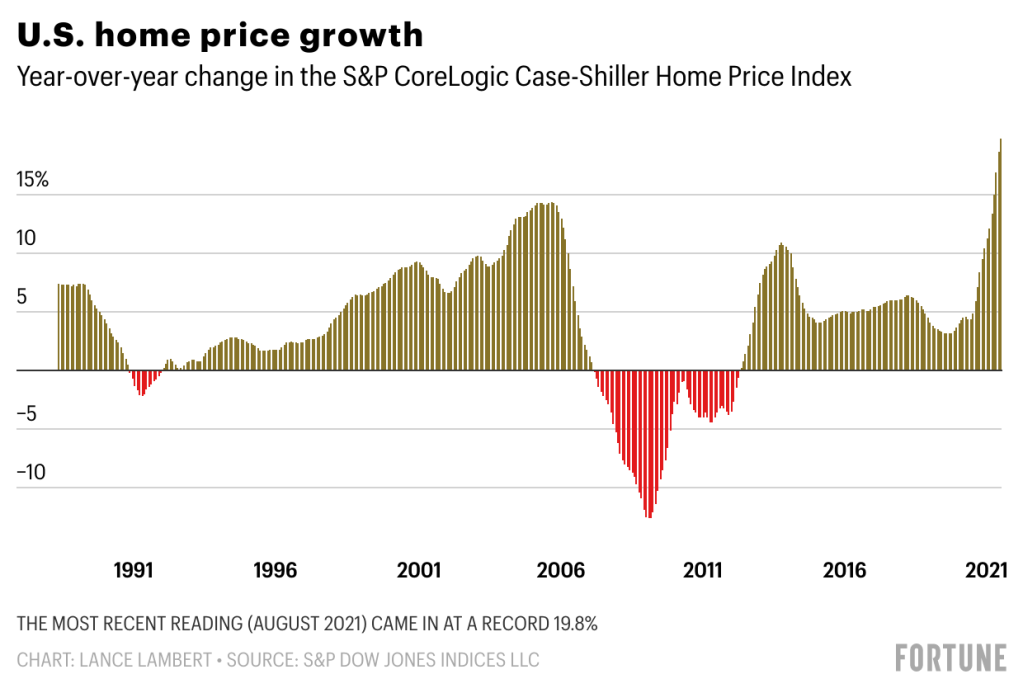

The pandemic brought record-breaking price increases and rent increases that made saving for down purchases much harder. As a result, according to a Zillow survey of recent buyers, the percentage of first-time home buyers fell from 45 percent in 2019 to 37 percent in 2021. First-time purchasers would reclaim their pre-pandemic market share within the next two years, with 26 percent predicting 2024 and 25 percent predicting 2025. About 18% of experts surveyed said they don't expect the percentage of first-time buyers to surge over 45% until after 2030, despite many Millennials, the largest U.S. generation ever will be well into their prime home-buying years far before then. The median age of U.S. buyers is 43, while the average skews higher (45 years old). Almost one in five buyers (17%) are in their twenties or younger, while roughly a quarter (23%) are in their sixties or older. In other words, the age distribution of buyers represents somewhat of a middle ground when it comes to the U.S. population. They are typically younger than tenured homeowners (those who have not moved in the past year), but older than renters. Buyers tend to have higher household incomes than the U.S. population overall. The annual median household income among buyers is approximately $86,000, compared to the overall national median (2019) of $65,700. Another Zillow Home Price Expectations survey conducted in June shows that despite a more than 100-basis point increase in mortgage rates since the previous survey just three months ago and the potential for higher rates in coming months, the panel’s expectations for 2022 home price appreciation still rose to 9.3% from 9.0% last quarter. This would be a significant step down from the 19.6% appreciation observed over the 2021 calendar year, but still high above long-term historical averages. Looking ahead, the most optimistic quartile of respondents expected a 46.1 percent increase in prices between now and the end of 2026, while the most conservative quartile predicted a 9.3 percent increase in that period. Respondents anticipate a total increase of 26.4 percent by the end of 2026. Over the past year, U.S. home prices are up a record 19.8%. You don’t need to be an economist to know that the current level of growth—which is faster than the run-up to the 2008 financial crisis—isn’t sustainable.

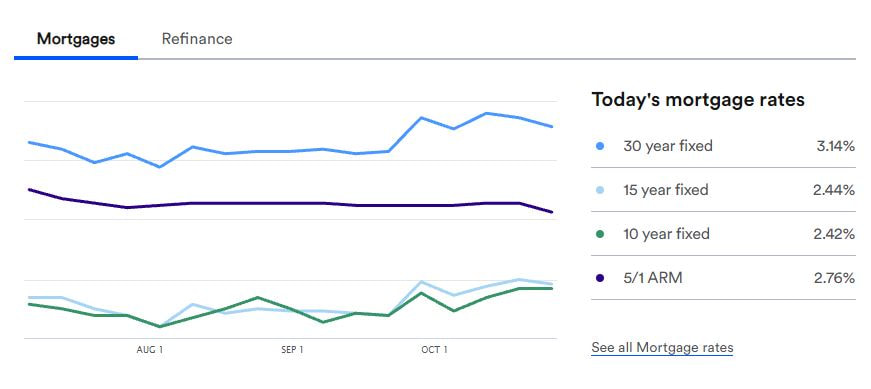

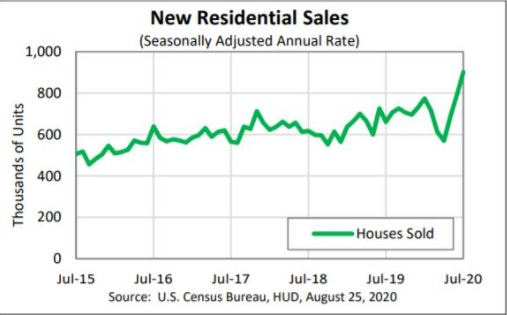

But where will this historically competitive housing market go next? According to the latest forecast put out by Fannie Mae, median home prices are expected to rise 7.9% between the fourth quarter of 2021 and the fourth quarter of 2022. While that would mark a slowing from the extreme price growth we’ve seen this year, it would still represent strong growth by historical standards. (On average, U.S. home prices have climbed 4.1% on an annual basis since 1987.) So, put another way: The housing market, at least in the eyes of Fannie Mae, is set to return to a normal-ish level of price appreciation. Fannie Mae also expects mortgage rates to climb next year, with the average 30-year fixed rate rising from 3.1% to 3.4%. But the downward pressure on prices from rising rates, the government-sponsored enterprise says, won’t be enough to actually pull prices down. “Mortgage rates may rise in response to the tighter environment, but we expect the severe shortage of homes for sale to remain the primary driver of strong house price appreciation through at least 2022, limiting interest rate effects on home sales and home prices,” wrote Doug Duncan, chief economist at Fannie Mae, in its latest 2022 outlook. As far as 2022 outlooks go, Fannie Mae’s forecast is a Goldilocks—right in the middle. On the bullish end of the spectrum are Zillow and Goldman Sachs. In the coming 12 months, Zillow foresees U.S. home prices jumping 13.6%. Meanwhile, Goldman Sachs expects home prices to swing up a staggering 16% by the end of 2022. But not everyone sees the frenzy continuing: CoreLogic, a real estate data firm, is far more bearish--forecasting just 2.2% home price growth over the coming 12 months. All of these forecasts should, of course, be taken with a grain of salt. After all, at the onset of the pandemic—when some states had banned in-person real estate viewings--CoreLogic forecast prices would fall 1.3% between April 2020 and April 2021. For that same 12-month period, Zillow predicted home prices would fall between 2% to 3%. Not only did the housing market not slide backward, it went on one of the biggest runs in U.S. history. Existing-Home Sales Increased 7% in September From August According to the National Association of Realtors®, existing-home sales increased in September after a decline the previous month. Each of the four main US areas had month-over-month growth. On a year-over-year basis, one area remained stable, while the other three showed declines in sales.

Thinking about selling your home in 2021? If so, you might want to consider selling it sooner rather than later.

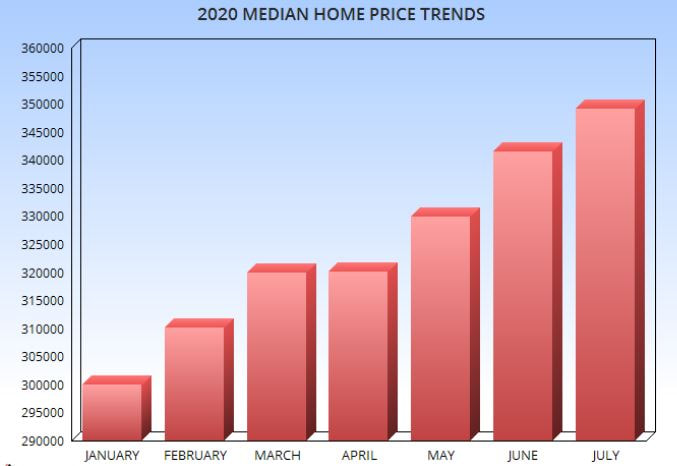

Current housing market conditions tend to favor sellers over buyers. Low mortgage rates have boosted demand among buyers, while low inventory conditions give sellers the upper hand. But all of this could change later in 2021. Rising home prices could cool the housing market over the coming months, especially if mortgage rates creep upward as well. Spring and Summer 2021: a Good Time to Sell It’s currently a strong seller’s market in most U.S. cities. But things could begin to shift toward the “center” later this year. Home prices continue to climb in most housing markets, and this could dampen demand going forward. Meanwhile, inventory growth could give buyers more options. Right now is a great time to sell a home. But six months from now, who knows. Here are three reasons why sellers across the U.S. might want to consider listing their homes for sale sooner rather than later: 1. Peak home selling “season” is coming. According to several industry analysts, we are now entering the ideal time to sell a home. Peak selling “season” starts in April and runs through July. That doesn’t mean you can’t sell a home in the fall or winter months. It just means you can probably sell your house faster, and possibly for a higher price, if you strike while the iron is hot. Postponing the sale until later in 2021, on the other hand, could make it harder to sell. While real estate market conditions can vary from one city or region to the next, experts say that spring and early summer are the best months for selling a house in the U.S. April 2021 housing market report from Realtor.com said that mid to late April is the absolute best time to sell a house. According to their analysis, the peak selling “season” extends through May. To quote that report: “When taking local market trends into account in the 50 largest U.S. metros, the best week to list varies by locale throughout March, April and May.” So that’s the first consideration for those planning to sell a home in 2021. If you’re looking to sell as quickly as possible, you might consider listing it sometime within the next three months. Sellers who go on the market during the spring and early summer could potentially sell their homes for more money, compared to those who wait until fall or winter. 2. Low inventory conditions currently favor sellers. Here’s something home buyers probably don’t want to hear right now. In most cities across the U.S., low inventory conditions have created a strong seller’s market. Tight supply conditions and strong demand have shifted the real estate market in favor of sellers. But it won’t be like this forever. In fact, there’s a strong chance that inventory levels will increase throughout the rest of this year, as more properties come onto the market. For now, however, housing market supply remains very low in most U.S. cities. This is another trend that favors sellers. Those who sell a home within the first half of 2021 will directly benefit from the ongoing supply shortage. According to a recent report from Realtor.com, the number of homes for sale nationwide dropped by -52% from March 2020 to March 2021. That’s a major reduction in supply. It translates to 534,000 fewer homes for sale in March of this year, compared to a year ago. Related: Housing market shrinks by half Some metro areas experienced an even bigger drop in inventory, over the past year or so. The number of homes for sale in Austin, Texas fell by -72.7% during the 12-month timeframe mentioned above. Jacksonville, Florida and Raleigh, North Carolina also experienced inventory declines greater than 70%. In these (and many other) housing markets across the country, selling a home has never been easier. Forget about painting, staging and landscaping. Just list the home, and then wait for the offers to pour in. Record-low inventory has home buyers lining up to make an offer. And in many cases, they’re willing to offer more than the list price. But we’re starting to see some improvement on the inventory front. It seems that more and more sellers are starting to list their homes for sale. This could shift the inventory situation, as we move into the latter part of 2021. If this trend continues, sellers might have to work a little harder to find the right buyer. 3. Rising prices and mortgage rates could cool the market. Record-low mortgage rates have helped fuel the housing market over the past year or so. Home sales remained strong throughout most of 2020, despite the coronavirus pandemic and resulting economic slowdown. And low mortgage rates were one of the primary factors driving that trend. During the first week of January 2021, the average rate for a 30-year fixed mortgage loan fell to a record low 2.65%. That was the lowest average in 50 years of record-keeping. But mortgage rates have risen since then. They rose steadily from February to March of this year, topping out at 3.18% by the beginning of April. In mid-April, 30-year mortgage rates dropped back down to around 3.04% (on average). There has been a recent uptick in rates We are currently seeing more volatility with mortgage rates, compared to the steady decline that occurred through 2020 in early 2021. Some forecasters, including the Mortgage Bankers Association and Freddie Mac, expect to see higher rates toward the end of this year and into 2022. This could have a cooling effect on the housing market, making it harder to sell a home. Rising home prices also play a role here — and arguably a bigger one. In most cities across the country, home prices rose steadily over the past 18 months. Not even a global pandemic could stop U.S. house prices from climbing. This is another important consideration for those planning to sell a home in 2021. As house values rise, it reduces the number of people who can afford to buy. It can shrink the pool of qualified buyers and cool the housing market. According to Zillow, the median home price in the U.S. rose by around 10% over the past year (as of April 2021). Looking forward, the company’s research team expects prices to continue climbing. In mid-April, the company’s website stated: “United States home values have gone up 9.9% over the past year and Zillow predicts they will rise 11.4% in the next year.” If home prices and mortgage rates climb over the coming months, it could create a “double whammy” effect that slows the housing market. Higher interest rates and house prices could squeeze many buyers out of the market. Something to consider, if you plan to sell your home in 2021. Bottom Line: Seller’s Market Won’t Last Forever To summarize, real estate conditions within many U.S. cities could change as we progress through 2021 and into 2022. Recent trends suggest that more sellers are now listing their homes for sale, and that could continue over the coming months. At the same time, steadily rising prices could reduce the pool of eligible home buyers. Higher mortgage rates could compound this effect. Both of these factors — but especially home prices — could reduce buyer demand as we move further into 2021. It’s currently a great time to sell a house, in most U.S. cities. Supply is low and demand is high. We also happen to be entering the peak selling season, based on data from previous years. But we don’t know how long the party will last, for sellers. Seasonality and 2020 Context: The Baseline In 2020, the seasonal pattern for home sales and other metrics was thrown out of whack by the timing of the coronavirus arrival as well as the shelter-at-home orders and other measures that were rolled out to arrest the spread of the virus. These measures were implemented just before what’s normally the best time of year for sellers to list a home for sale, and housing inventory never fully made up the gap as buyers returned in earnest before sellers. This uneven return of buyers and sellers created a housing market frenzy that pushed the number of sales to decade highs while time on market dropped to new lows. This trend persisted well into the fall, a time when normal seasonal trends typically favor home buyers over sellers, thus buyers hoping for the usual break in 2020 were likely disappointed. Understanding this backdrop will be key to evaluating the data as it comes in for 2021 as we expect the housing market to settle into a much more normal pattern than the wild swings we saw in 2020. Year over year trends will need to be understood in the context of the unusual 2020 base year.

Home Sales After whipsawing in tremendous fashion in early 2020, the housing market more than regained its early-year momentum to finish at new highs for home sales in the fall. For the year, we expect 2020 home sales to register slightly higher (0.9%) than the 2019 total thanks to the strong, if delayed, buying season. Going into 2021, we expect home sales activity to slow from those frenzied levels which represented underlying housing demand as well as make-up buying for a spring season many buyers missed out on plus a sense of urgency brought on by record low mortgage rates. As sub-3 percent mortgage rates start to feel less exceptional, buyers may not react with the same immediacy to take advantage of them, initially, though as rates start to rise in the second half of 2021, buyers may feel the need to hurry purchases along to lock in a low rate. Additionally, as make-up buying from the disruption of spring 2020 fades, home purchases will be propelled by underlying demand in 2021. This demand will come from a healthy share of Millennial and Gen-Z first-time buyers as well as trade-up buyers from the Millennial and older generations. We expect home sales in 2021 to come in 7.0% above 2020 levels, following a more normal seasonal trend and building momentum through the spring and sustaining the pace in the second half of the year. While home sales are expected to lose some momentum over the last months of 2020, the shallower than normal seasonal slowdown creates a higher base of activity leading into 2021 that is roughly maintained for the first half of the year. As vaccines for the coronavirus become broadly available to the public, and economic growth reflects the resumption of more normal patterns of consumer spending, home sales gain even more in the second half of the year. Home Prices With the already limited inventory of homes for sale relative to buyers pushed further out of balance by the pandemic that brought out buyers in mass and kept many sellers pondering their options, home prices skyrocketed surging up more than 10 percent over year-ago levels by the late fall. We expect the momentum of home price growth to slow as more sellers come to market and mortgage rates settle into a sideways pattern and eventually begin to turn higher. The large number of buyers in the market, including many Gen-Zers looking to buy their first-home and Millennials who are both first-time and trade-up buyers will keep upward pressure on home prices, but rising numbers of home sellers will provide a better relief valve for that pressure. We expect home prices in 2020 to end 7.6% above 2019, after a seeing near record high boost in the summer and early fall, but beginning to decelerate into the holidays. From there, we expect price gains to ease somewhat in 2021 and end 5.7% above 2020 levels, decelerating steadily through the spring and summer, and then gradually reaccelerating toward the end of the year. Inventory Although the housing market is healing and by many measures doing better than before the pandemic, inventory remains housing’s long haul symptom. There were an insufficient number of homes for sale going into 2020 in large part due to an estimated shortfall of nearly 4 million newly constructed homes. Much to the surprise of many, the coronavirus and recession did not lead to a distressed seller driven inventory surge as we saw in the previous recession, but further reduced the number of homes available for sale. Starting in fall 2020 the housing market saw more than half a million fewer homes available for sale than the prior year. We expect to see an improvement in the pace of inventory declines starting just before the end of 2020 that will continue into Spring 2021, so that while the number of for-sale homes will be lower than one year ago, the size of those declines will drop. We expect a more normal seasonal pattern to emerge which will contrast with the unusual 2020 base and lead to odd year over year trends, but taken as a whole we expect inventories to improve and, by the end of 2021, we may see inventories finally register an increase for the first-time since 2019. While total inventories will remain relatively low thanks to strong buyer demand, the number of new homes available for sale and existing home sellers, what we call “newly listed homes,” will be more numerous which will help power the expected increases in home sales. Key Housing Trends 2021 TRENDS: Millennials & Gen Z The largest generation in history, millennials will continue to shape the housing market as they become an even larger player. The oldest millennials will turn 40 in 2021 while the younger end of the generation will turn 25. Older millennials will be trade-up buyers with many having owned their first homes long enough to see substantial equity gains, while the larger, younger segment of the generation age into key years for first-time homebuying. At the same time, Gen Z buyers, who are 24 and younger in 2021, will continue their early foray into the housing market. In early 2020, younger generations, including Millennials and Gen Z, were putting down smaller downpayments and taking on larger debts to take advantage of low mortgage rates despite rising home prices. In fact, only a quarter of respondents to a summer survey reported lowering their monthly mortgage budget or not changing their home search criteria in response to lower mortgage rates. The other three-quarters said low rates would enable them to make a change to their home search, and the most commonly cited change was buying a larger home in a nicer neighborhood. We expect these trends to persist as rising home prices require larger upfront down payments as well as a bigger ongoing monthly payment due to the end of mortgage rate declines. Early in the pandemic period, there was concern that temporary income losses could prove to be particularly disruptive to younger generations’ plans for homeownership, as these were the groups expected to face income disruptions that might require dipping into savings which would otherwise be used for a down payment. Thus far, these disruptions have not had an effect on overall home sales, and some home shoppers report an ability to save more money for a downpayment as a result of sheltering at home, but we are still not completely through the pandemic-related economic disruption. 2021 TRENDS: Remote Work As we discussed in early 2020, the ability to work from home is not new. In fact, as long ago as 2018, roughly one-quarter of workers worked at home, up from just 15 percent in 2001. More recently, a scan of real estate listings on realtor.com in early 2020 showed that in the ten metro markets where they are most common, as many as 1-in-5 to 1-in-3 home listings mentioned an “office.” Remote working was already more common among home shoppers than the general working population, with more than one-third of home shoppers reporting that they worked remotely even before the coronavirus. Additionally, remote working has gained an unprecedented prominence in response to stay-at-home orders and continued measures to quell the spread of the coronavirus. Another 37 percent of home shoppers reported working remotely as a result of the coronavirus. While a majority of home shoppers reported a preference for working remotely, three-quarters of workers expect to return to the office at least part-time at some point in the future. However, the ability to work remotely was a factor prompting a majority of respondents to buy a home in 2020. This was the case even when most expected to return to offices sometime in 2020. As remote work extends into 2021 and in some cases employers grant employees the flexibility to continue remote work indefinitely, expect home listings to showcase features that support remote work such as home offices, zoom rooms, high-speed internet connections, quiet yards that facilitate outdoor office work, and proximity to coffee shops and other businesses that offer back-up internet and a break from being at home, which can feel monotonous to some, to become more prevalent 2021 TRENDS: Suburban Migration With remote work becoming much more common, home shopping in suburban areas had a stronger post-COVID lockdown bounceback than shopping in urban areas, starting in the spring and continuingthrough the summer. These trends, which have been visible in rental data as well, suggest that city-dwellers—freed from the daily tether of a commute to the office and looking for affordable space to shelter, work, learn, and live—were finding the answer in the suburbs. In fact, a summer survey of home shoppers showed that while a majority of respondents reported no change in their willingness to commute, among those who did report a change,three of every four reported an increased willingness to commute or live further from the office. Even before the pandemic, homebuyers looking for affordability were finding it in areas outside of urban cores. The pandemic has merely accelerated this previous trend by giving homebuyers additional reasons to move farther from downtown. Housing Market Perspectives What will 2021 be like for buyers? The housing market in 2021 will be much more hospitable for buyers as an increased number of existing sellers and ramp up in new construction restore some bargaining power for buyers, especially in the second half of the year. Still-low mortgage rates help buyers afford home price increases that will be much more manageable than the price increases seen in 2020. With companies continuing to allow workers more flexibility, we see the inner as well as outer suburbs and smaller towns continuing to entice home buyers and builders. Areas that can ramp up affordable housing supply will benefit and see an influx of buyers. While buyers will be able to visit homes in person, a strong preference for most shopping to buy, they will take advantage of the industry’s acceleration toward technology to check out homes, explore neighborhoods, and research the purchase online, saving time and energy to focus on a more selectively curated list of homes to view in person. Although the pace will slow from late 2020’s frenzy, fast sales will remain the norm in many parts of the country which will be a challenge felt particularly for first-time buyers learning the ins and outs of making a major decision in a fast-moving environment. Buyers who prepare by honing in on the neighborhood and home characteristics that are must-haves vs. nice-to-haves and lining up financing including a pre-approval will have an edge. What will 2021 be like for sellers? Sellers will be in a good position in 2021. Home prices will hit new highs, even though the pace of growth slows. Buyers will remain plentiful and low mortgage rates keep purchasing power healthy, but monthly mortgage costs will rise as mortgage rates steady and home prices continue to rise. Sellers hoping to see further double-digit price gains will likely be disappointed, but those setting reasonable expectations can expect to see a timely sale and will want to focus on their next move. The coronavirus pandemic has remade what's normal, and homebuying is no exception. Typically, the real estate market tends to hit the brakes in the fall, as kids return to school and families juggle work, extracurriculars and the upcoming holidays. But that's not what's happening as we head into the second week of September, closing in on the official start of fall: Sept. 22. Homes are getting snapped up faster as home values rise and mortgage rates continue to slide. Home sales are currently stronger than they were pre-pandemic and show no signs of slowing. Demand is being fueled by low mortgage rates. We're also seeing deferred home buying as the economy and housing market pressed pause in the spring. The median listing price on single-family homes grew for the 17th straight week, jumping 10.8% year-over-year, which is the most rapid growth in over two years. Meanwhile, mortgage rates have broken new records. The average rate on the 30-year fixed-rate mortgage is now at 2.86%, and the 15-year hit 2.37% this week-both all-time lows, according to Freddie Mac's recent Primary Mortgage Market Survey. As the number of homes for sale continues to shrink, new listings are being snapped up quickly. They're lasting 12 fewer days on the market than they were 12 months ago, according to Realtor.com's latest housing trends report. "With unusually high buyer interest this late in the homebuying season, buyers are moving much faster than this time last year to beat out competition and lock in low mortgage rates. This means homes are sitting on the market for much less time, despite notably higher price tags," the report's author, Realtor.com economist Danielle Hale, wrote. Whether this buying trend will continue is up in the air as supply is lagging behind demand, which appears to be the only real obstacle. What's holding home buying back now are chronically low levels of inventory, Johnson says, and stiff competition for homes that do come onto the market. New listings dropped 12% during the week ending on Sept. 5, which spells trouble if construction doesn't pick up. This is especially harmful for first-time buyers who are competing against a slew of bids for the same listing. "Multiple offers are quite common for starter homes," says Lawrence Yun, chief economist at the National Association of Realtors (NAR). Why is Homebuying taking off so much right now? Experts can't point to one reason why homebuying has defied expectations as we face a still uncertain economy and elevated levels of unemployment. Certainly, the Federal Reserve and GSEs, Fannie Mae and Freddie Mac, helped keep the market liquid so lenders could continue to do business as well as contain mortgage rates. But why is there such a big appetite for real estate now? Low mortgage rates? People fleeing cities? The need for more space as working from home and remote learning become realities? Dormant buyers who were waiting for the pandemic to subside? It's likely a combination of a few or all of these factors. Homebuying is currently on a tear, but much of this is likely due to the fact that those looking to buy during the spring homebuying season had to wait as the pandemic took hold. One influence that is undeniable in the recent buying spree is the rise of the ultra-low mortgage rate, says Yun of NAR. Buyers who were held back from buying during the spring watched mortgage rates drop. Now that businesses are opening up and more people are finding ways to live with the coronavirus safely, the homebuying hesitancy has subsided. Low rates are just adding extra impetus to what was already a motivated buying segment. "Low rates are the key reason for the robust homebuying, despite the still-high unemployment rate," Yun says. "Those with secure employment are taking advantage of the low interest rates." The circumstances surrounding the pandemic have created homebuyers, as well, says Bill Cosgrove, president and CEO of Union Home Mortgage. People are using their kitchens for office space and spare bedrooms for classrooms, so many of them are looking to upsize. Not only do they want more square footage, but they want to get away from urban cores so they can also have outdoor space. "Our understanding of what 'home' needs to be has really expanded in 2020 and it's happening with homebuyers of all types," Cosgrove says. How has the Pandemic shaped the real estate market? Real estate experts agree the coronavirus has changed what people are looking for in a home-but to what extent is up for debate. For example, are people really abandoning New York and other major cities? At least, enough to call it a "trend." Headlines have suggested that people are leaving dense urban centers like New York to buy houses in the suburbs where land is plentiful and their neighbors are not within six feet. However, even with increased interest in places like upstate New York post-COVID, there's still not enough data to identify a meaningful pattern. Zillow examined whether or not there was a shift in where people want to live, especially in terms of cities and suburbs as more people spend time working and learning from home. "After analyzing a slew of housing market data, we have not seen suburban markets strengthen compared to urban ones, nor an increase in search activity for single-family detached homes," Young says. New York-based real estate broker at Warburg Realty, Tania Isacoff Friedland, says that her clients have expressed interest in more space, but they're not necessarily leaving the city. Many want to trade in their penthouse for a townhouse, rather than ditch their Manhattan ZIP code for something pastoral. "There have been many stories about an urban exodus, but my clients have been bullish about the future of New York City and are still investing here," Isacoff Friedland says. Regardless of where you live, extra space is commanding buyer interest. The prospect of permanently working from home and schools requiring remote learning has caused homebuyers to reevaluate how much room they need. Even after the coronavirus is contained, there will still be people who continue to work from home, Yun says. Additional considerations like multigenerational living (wherein extended family moves in), as well as using the home as a recreational space, have driven interest in the "destination home," says Cosgrove of Union Home Mortgage. The "destination home" is a one-stop-shop for homeowners who face more at-home time and it might include space for outdoor activities, social gatherings, work and privacy. "The COVID-19 pandemic has forced all of us to spend a lot more time in our homes more than ever before. The destination home is a place where family and friends can gather compared to going out," Cosgrove says. Call/Text Phillip Varela 505.570.9700 |

|

NMREC# 18075

|

Address

1526 Cerrillos Rd.

Santa Fe, NM 87505 Toll-Free: 1-800-982-3084 Office: 505-982-2525 Fax: 505-984-8595 [email protected] |

Map

|

© 1999-2021 Varela Real Estate, All Rights Reserved. Real Estate Website by MIS, Inc.

RSS Feed

RSS Feed